-

High Tax, Capped Rents: Why Landlords Need Advice Ahead of 2026

Irish landlords face the biggest rental shake-up in a generation. From March 2026, rent caps, six-year rolling tenancies and stricter eviction rules will apply nationwide. Add in high taxes and limited reliefs, and the…

-

Caught in the Storm: Hospitality’s Struggle Ahead of Budget 2026

With Budget 2026 set to be announced on 7 October 2025, the hospitality industry is holding its breath… The Reality Facing Irish Hospitality The Irish hospitality sector is facing financial stressors from all sides…

-

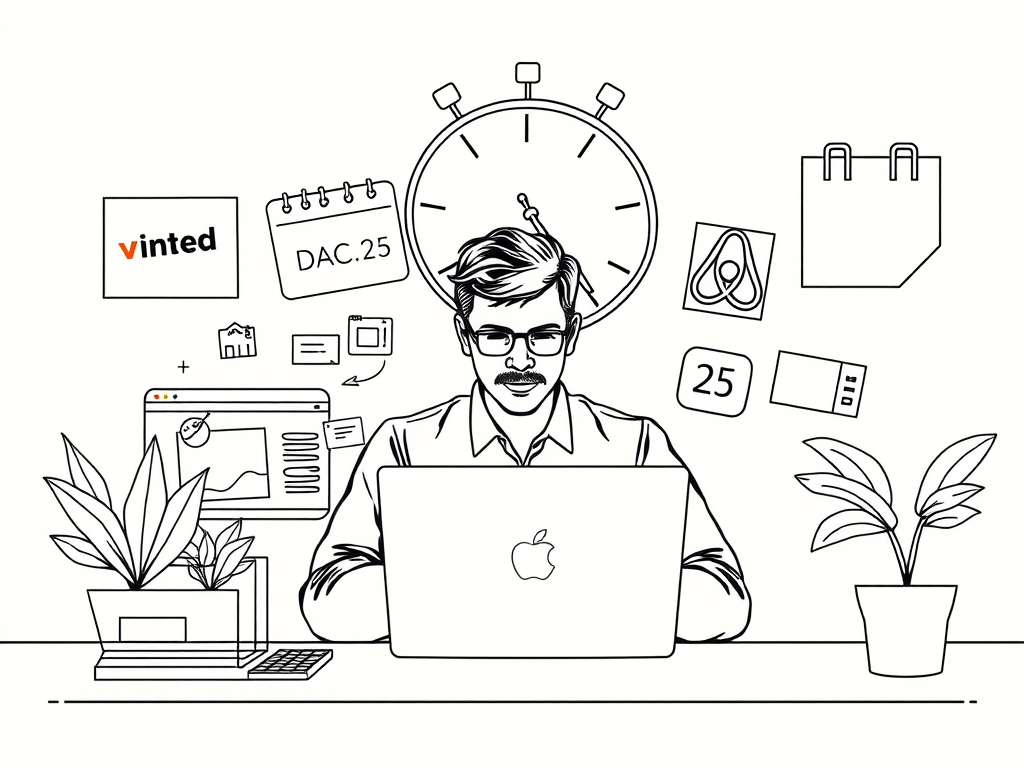

Your Income Has Been Reported! What DAC7 Means & why the 2025 tax deadline is key

DAC7 (Directive 2021/514) is part of the EU’s broader tax cooperation strategy. It makes platforms (like Airbnb, Etsy, Vinted, Depop, and Fiverr) report certain income and key details of sellers on the platforms. …

-

VAT Registration Before Revenue: Is It Possible?

If you’re setting up a new business and haven’t yet made any sales, you might assume VAT registration isn’t relevant yet. You can register for VAT Pre-revenue Brace yourself, we’re getting into case law.…

-

Vinted, Depop & “Side Hustles”: Understanding the €5,000 Tax Exemption in Ireland

If you sell on platforms like Vinted, Depop, or Instagram, and your income from these sources is less than €5,000 in a tax year, you may not need to register for self-assessment. Instead, you…

-

How Your Money Mindset Shapes Financial Habits

We’ve got spreadsheets, savings apps, and even the old school envelope system making a comeback (yes, that’s not a new thing), but how often do we actually stop to look at our money mindset?…

-

VAT, Pre-Trading Expenses & Loss Relief: The 3 Traps That can cost you!

If you’re launching your business and you’re deep into Google searches trying to figure out VAT, expense claims and startup losses, you’re not alone. But there are a few traps that come up again…

-

Vinted Ireland: So, What’s That All About?

If you live in Ireland, you’ve probably heard someone mention Vinted lately. It seems like everyone’s at it. Even my mother knows about it. In case you haven’t come across it yet, Vinted is…

-

Why Bookkeeping Is More Than Just Data Entry

With the rise of accounting software and automation, it’s easy to assume that bookkeeping has become a simple data entry routine or that it basically does itself. Just connect the bank feeds, let the…